PATHFINDER, our DIY financial planning system delivers lasting financial wellbeing for your team.

Financially stressed employees are twice as likely to quit. With vision-led education, skills training, and automated tools, we’re putting a stop to that.

We help your workforce worry less and feel more secure about their financial present, and future.

Research shows financial wellbeing-supported teams enjoy more consistent cultural cohesion, reduced absenteeism, amplified efficiency, increased productivity, and enhanced creativity.

With financial insight staff can leapfrog the stressful, anxiety-inducing, often mentally debilitating, and opportunity-missing consequences of not knowing exactly where they stand financially across time.

Our fully supported money management approach significantly reduces the need for employees to get bogged down having to track household budgets and log personal spending.

Equipped with online training, tools, and tutelage that separate money reality from financial fiction personnel learn to quickly and easily navigate short, medium, and long-term financial decisions at home, work, and the office with improved foresight.

We empower your employee team to see their money future clearly and contextually, today.

So they can make more informed choices and take considered action ahead of time, without delay.

To transform their default go-to Money Map and enjoy a better, bolder, brighter tomorrow.

What about Implementation and onboarding? That’s on us.

Flowcasting™ PATHINDER is the forward-looking, goal-centred, money management method designed to inspire the creative in us all to action.

Our MONEY MATTERS Mindset Mapping training course and Flowcast™ SUPER-TOOL Xtra combined with a diverse inclusive support suite give employees all they need to confidently and confidentially navigate their day-to-day and bigger-picture financial decisions with more clarity, certainty, and control.

Implementation? We’ve considered it all so you don’t have to.

-

-

Firstly there can be a stigma attached to being seen to seek out guidance, advice or support especially when it comes to personal money and finance.

By offering a diverse range of support options your employees can take advantage of the benefits of doing so while remaining anonymous.

Your team’s individual personal relationship with Flowcastic™ is independent, objective, private, and confidential. They sign up with their work email but are permitted (within the terms of use) to use the Flowcast™ MINI-TOOL and SUPER-TOOL with a personal Google account, and are encouraged to communicate with our team via a personal email as and when they see fit to maintain confidentiality.

This means their Flowcast™ data is only accessible by and visible to them unless they choose to share it directly with Flowcastic™ for troubleshooting, training, or coaching support purposes.

Email and chat support is 1-2-1 and can be carried out with a work or personal email so nobody else is aware of or has access to any correspondence.

During group Zoom calls participants can choose to remain anonymous. However, If they wish to receive support related to a specific or senstive financial scenario there is also the option for Flowacstic™ to provide private 1-2-1 first-come, first-served Flowcast(ing)™ clinics, and 1-2-1 training and coaching session packages.

-

-

Not every employee has the need or time to join a financial wellbeing programme from the get-go and will work through the content at their own pace and only start using the tools when they’re ready.

To maintain affordability while being able to facilitate implementation, internal promotion, onboarding, and ongoing employee engagement, complete with a sufficiently diverse range of inclusive support our pricing is based on:

A rolling twelve-month commitment window, overall headcount at the beginning of each term, average adoption rates, and extent of support uptake.

Predictable budgeting is achieved through a monthly charge per headcount payable in advance monthly or yearly up-front with a significant discount serving to further increase affordability.

For enhanced privacy and confidentiality bolt-on and ad-hoc 1-2-1 training and coaching first-come, first-served Flowcast(ing) regular clinics and session packages are tailored and priced to your needs.

Visit our pricing page for more details.

-

Knowing where you stand financially now, today is only a small piece of the money puzzle.

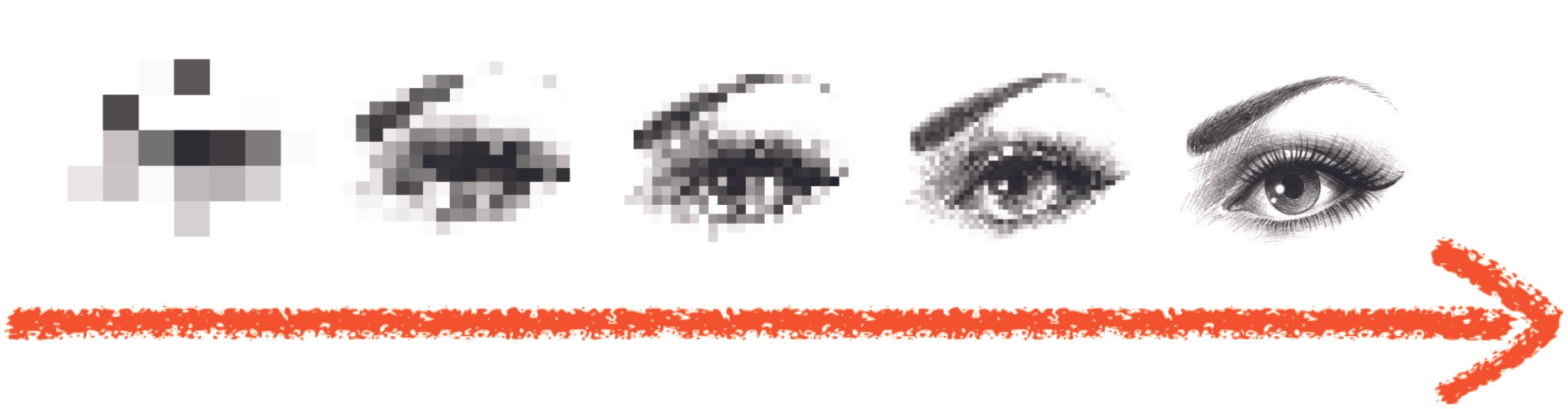

That’s why we’re very specifically focussed on the seer-like solution we’re offering. We believe when you can see your money future clearly in the context of all your regular, irregular, and ad hoc incomings and outgoings, alongside your aspirational visionary scenarios across time your perspective will change.

You’ll quickly transition from the debilitating option paralysis of not knowing to making more informed, timely, and contextually considered choices with greater clarity, confidence, certainty, and control.

When you look at the compounding effect of your adopted money map (behaviours, actions, and habits) across time the impact your decision-making, has on your financial future is, for good or bad, inescapable. You’ll be compelled to change how you see and manage your money for the better.

You’ll start logging personal spending, tracking household budgets, and changing habits not because you should but because you understand and appreciate the benefits of expanding and refining your money map, and simply want to.

Flowcasting™ is the art and craft of creating your day-to-day financial roadmap. By giving you the power to see where you are now and where you’re heading It underpins and strengthens everything else important to personal money management.

That’s why it’s foundational, forward-looking, and vision-led. The Flowcast™ SUPER-TOOL doesn’t rely on up-to-date historical data or need to be hooked up to any other applications, systems, or institutions.

You don’t need to be a financial advisor or a wealth planner to be prepared for undesirable, desirable, unexpected, or expected economic situations.

Flowcasting™ is standalone yet complementary and bolsters any other financial wellbeing initiatives you’ve implemented or are considering.

-

We know you’re busy and finding the time and energy to organise the roll-out of a new initiative can be overwhelming to the extent you’d absolutely love it if someone could just do it all for you!

Rest assured we can and will do it all for you.

Our account-managed internal promotion, incentivised invitation, student nurturing, streamlined onboarding, and ongoing engagement system have led to the highest financial wellbeing initiative uptake and engagement rates in the industry.

You only need to provide us with a list of names, emails, telephone numbers (optional), and an initiative announcement date and we’re good to go.

However, we also know that despite how time-strapped you are right now you may still want to be actively involved in and enjoy tailoring PATHFINDER’s onboarding and ongoing management.

Regardless of how hands-on you want to be, we’re keeping it super simple yet sophisticated.

Firstly, you’ll be invited to experience the PATHFINDER roll-out process yourself before pressing go.

It’s important to us all that the way we communicate with your team meets your evolving requirements and continues to exceed your expectations.

We’ve designed a white-labelled company-branded onboarding approach that allows us to personalise and tailor our email sequence to include messages from key personnel within your organisation.

You’re welcome to provide feedback on the copy tone of voice and frequency of emails.

There is also an option to have a Flowcastic™ representative connect directly with your individual team members by telephone or Zoom to ensure they’re aware of the PATHFINDER initiative, answer any of their questions, and offer support.

And of course, if white labelling isn’t your thing, we have an off-the-shelf field-tested onboarding email sequence ready to go at a moment’s notice.

Regular account check-ins and ongoing project management by the Flowcastic™ team, along with the support of your dedicated account manager, come naturally to us. We tailor and adapt the onboarding process to align with the cultural nuances of your business. Our expertise lies in guiding you and your team objectively through the foundational landscape of financial wellbeing.

For Businesses

PATHFINDER

Comprehensive vision-led creative money matters mindset mapping training, practical tools, courses, case studies, and demonstrations for your employee team PLUS:

A powerful, simple yet sophisticated, easy-to-use, rolling, automated, dynamic, contextual budgeting, cash flow forecasting, wealth planning, and financial modelling SUPER-TOOL, email and chat support, regular group Q+A sessions, with optional 1-2-1 clinic, personal training, and coaching session packages.

For Individuals

MONEY MAPPING *

Everything a beginner needs to start creating automated, contextual budgets, cash flow forecasts, and wealth plans quickly and easily for life, projects, and business.

An affordable, low-cost, fully supported self-paced online beginner on-ramp vision-led money mindset and money mapping starter system for technophile and technophobe designers, inventors, artists, authors, creators, yoga teachers, wellness professionals, consultants, coaches, and healers.

* MONEY MAPPING is included with PATHFINDER

'Your system stood out as engaging and fun; a forward-looking self-motivating approach to personal money management that’s easy to grasp and not too dry or all about the numbers.’

Sign up to download your employer’s guide to vision-led financial wellbeing strategies and solutions for your team.

Please email support or live chat if you have any problems signing up and downloading your guide.

PATHFINDER GUIDES

Discover short reads, in-depth presentations, money mindset course content samples, and Flowcast™ SUPER-TOOL Xtra demonstration videos.

Our aim is to help employees overcome economic, emotional, mental, and creative obstacles on their journey to sustainable financial wellbeing.

PATHFINDER TRIAL

The risk-free way to appreciate the powerful enduring financial wellbeing PATHFINDER benefits of Flowcasting™ is for your employee team to try it.

Use our trial cohort onboarding, engagement, and student nurturing system to save time, and effort, or just allow us to organise it for you free of charge.